THE biggest news in economic statistics as we start 2022 is the forecast that the World’s economic output will exceed $100 trillion for the first time in history. This is according to the Centre for Economics and Business Research, the London based think tank.

Before this report, the International Monetary Fund (IMF) had already predicted that the global Gross Domestic Product (GDP) measured in dollar and in current prices would pass $100 trillion in 2022. One would think this is good news, of course it is but it is not as well! It is not good enough and does not give any confidence to the World economy.

Why?

In 2021, the World experienced the outbreak of inflations manifested in spikes on energy prices, dysfunctional supply chains and uncertainty in political corridors. Most of the forecasts on global GDP, take into account the continued recovery from the pandemic although they are cautious because if inflation will persist, it may be hard for economic thinkers to avoid tipping their economies back into recession.

One of the defining features of the pandemic has been to accelerate many economic trends that existed before 2020. And here, I take a look at the four factors that are likely to shape the global economy.

“BUBBLETS” IN BUBBLES.

The asset prices are rising with low interest rates which fuel the rising asset prices like stock prices as indicated. A clear picture is revealing itself in America’s stocks which are at all time high since 1982. So, the question is; are there bubbles in the markets?

Maybe not, but what is vivid is the presence of what financial economists call “bubblets”. In economic-talk, these are potential elements in causing bubbles in the markets. The year 2022 is starting with full bubblets like electric vehicles, clean energy and technological stocks like Spotify, okta or, and crypto-currency, these are not new concepts, but most of them have started to deflate.

Their prices are already down between 39% to 43% from their peak and my prediction is that they have a much further way to go. Other sources like Morgan Stanley Investment Management shows a deeper decline. Bitcoin is down by 53%, Green Energy down by 49% and the unprofitable tech is down by 49%.

What is critical to observe here is that, many small and retail investors rushed to buy them in the last two years but at the same time the insiders like big CEOs are selling the stocks of the very companies. This mismatch is a worrying sign for the markets.

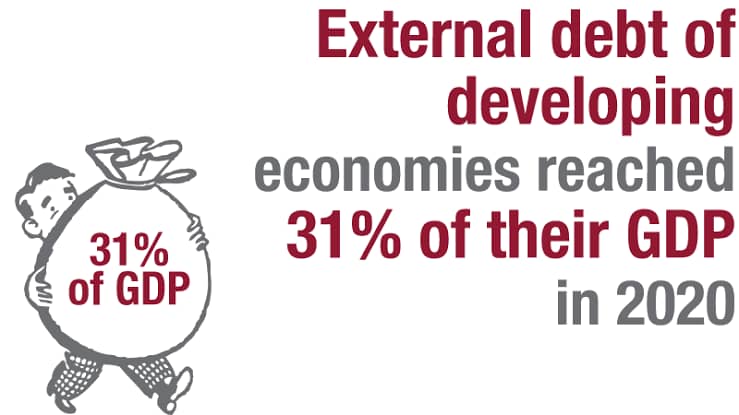

THE BALLOONING DEBTS

The World major economies have been piling up massive debts for the last fifteen years. A different picture has been painted in the last two years. Today, as per IIF: HAVER-Institute of International Finance, there are 27 countries in the world with over 300% of their Debt to GDP ratios. In simple terms, this means a country’s debt is three times (3×) higher than the size of her economy.

Data show that; in 1994, there was no country with Debt/GDP ratio at 300%. In just 27 years, there are 27 countries with that ratio.

The fact is, massive amount of debts have been taken on during the pandemic. We saw a sharp rise in debt levels led by governments around the world. It is accepted to do so during a crisis, nut the problem is; countries keep on accumulating new debts.

This has some serious implications, not in terms of real economic crisis; but something more insidious that by taking so much debt, we are supporying a lot of inefficient companies and a lot of zombie kind of corporations. This undermines productivity.

A SLEEPY CHINA

Whereas many economies accelerated in 2021, China experienced major slowdowns in her economic growth rate. What is interesting is that the world economy is not so concerned with this trend.

This is a big change taking place in relation to China’s influence in the global economy. The contribution of China to the global economy will keep dwindling. In 2020, China alone contributed 40% of the global economic growth, which is now 25% and the trend is expected to continue.

On the other hand, China faces serious structural challenges ranging from declining population and the increasing debt that is crippling production. And 2022 is not expected to be any better.

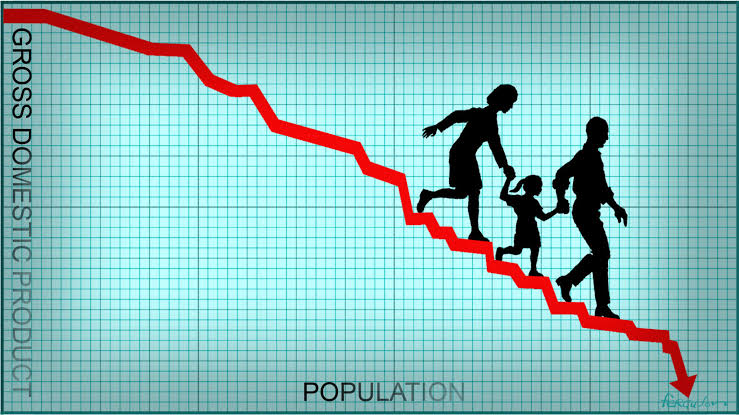

DEMOGRAPHIC SHIFT

The world’s working age populations as well as population growth rates have been slowing down for the past ten years before the pandemic. According to the World Bank (WB) figures, the world working population age (15-64) declined from 65.6% (2014) to 65.2% (2020) and population growth rate from 1.2% (2014) to 1.0 % (2020)

One would have expected that during the pandemic with people staying indoors there would be more new babies born but instead, the demographic declined hence negatively affecting the global economic growth.

This baby bust is likely to have short and long term effects on growth in terms of labor mobility and eventually innovation. In the short-term, consequences are expected to commence in the year 2022.

I may be wrong, but neither did I choose to be right.