LAST week around the world, central banks were in a frenzy of Monetary Policy Committees'(PMC) press briefings to give what is now dubbed as an effective monetary policy strategic communication tool. In this tool, lies the macro-economic trends of monetary policy spectrum mainly economic growth and interest rate.

As a strategic communication tool, Africa’s central banks have recently deployed this tool with the chutzpah to claim credit for controlling the rise of consumer prices through central bank rates(CBR).

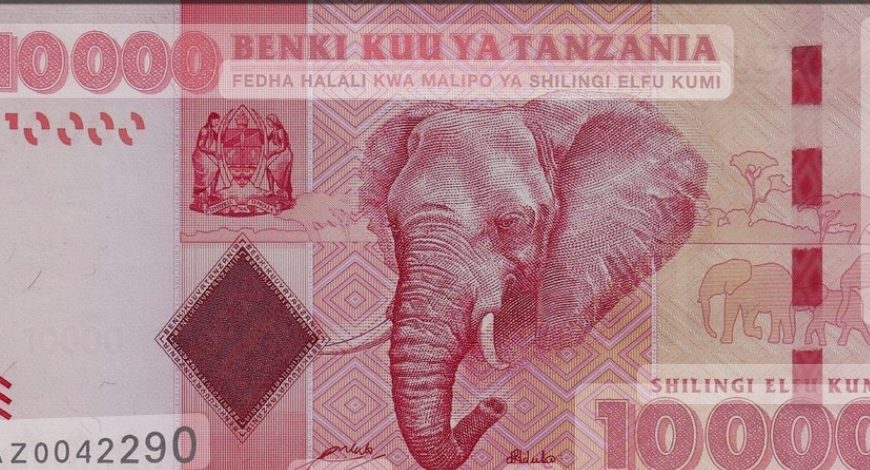

Our central bank, Bank of Tanzania (BOT) had one last week as well. The central bank governor, Emmanuel Tutuba who is the chair of the MPC stated that Tanzania’s economy is growing at 5.1 percent and inflation was at 3.0 percent in the first quarter(within inflation target of 5 percent) and that the economy is healthy. Of importance, is that, BoT through MPC raised CBR to 6.0 percent from 5.5% of the first quarter of 2024.

INTEREST RATE

Interest rate is the cost of credit; the amount market players agree to pay lenders for using their certain quantity of money including accounting risks. For example, a stalled business could make it problematic for the market player to repay the lender.

Since different market players have different risk propensities, there exists different rates in the economy.

1). Lending Rate; the rate banks charge for a loan. Sometimes both licensed and unlicensed microlenders charge above the rate.

2). Saving Rate; the rate for deposit(s).

3). The Interbank Rate; what banks charge other banks for overnight lending.

4). Treasury Bill Rate; is what people demand and that government is willing to pay when it borrows from them for normally a short period of time.

5). Central Bank Rate: as the key central bank tool for monetary policy. The influencer-in-chief of all other interest rates.

When the BoT believes the economy is in a boiler room, it raises interest rates to slow consumption and investment as it curbs inflation. And the economy in a cold room, invites the BoT to slow interest rates thereby pushing up consumption and investment.

THE DILEMMA

Whereas the BoT policy statement committee is viewed as best practice in monetary policy communication, the economic logic of raising central bank rate(CBR) to slow inflation has proved to be muss and fuss. All we are embroiled in as the economy is dancing in the business cycle of the developed nations.

Not the business cycle of our economy.

In developed countries, the fiscal and monetary policies “independently” shape long-term sustainable economic perspectives. And it is not hard to know why!

They are in full- employment levels of economic transformation. This does not obtain in Tanzania and her peer.

In these countries, the full- employment- short-term economic policies such as the raising interest rate regime are painfully irrelevant. Even when MPC’s interest rate decision purpose to target Non-Food Non-Fuel Inflation, the intended consequences on inflation do not reflect commensurately. This regime has three serious dangers.

Data indicate the inverse relationship between CBR increase and supply-side inflation especially when we consider inflation as a class issues manifested in “silent inflation” in Tanzania.

Inflation is a class issues in Tanzania by the way!

Secondly, higher interest rate affect private sector and ultimately investment which in turn keep inflation above poverty rate alleviation.

Thirdly, higher CBR increases the cost of servicing domestic debt. In other words, domestic debt balloons when CBR increases.

In Friedrich Hayek’s preposition, which I consider to be classic; central banks should be cognizant of the said macro-economic dangers even as they deal with macroeconomic stability.

Short of which, stabilization policy turns into destabilization policy. My prayer is that it is not by design. Anyways!

Hayek posits:

The absence of any central bank, the strongest restraint in individual banks against extending excessive credit in the rising phase of economic activity is the need to maintain sufficient liquidity to face the demands of a period of tight money from their own resources

NEUTRAL RATE OF INTEREST?

Both in the North and South, some countries have recently put into use the neutral rate of interest to determine policy rate.

Neutral Rate of Interest neither stimulates nor restrain economic growth. It is just the long-term rate of price stabilization.

Due to weakening productivity growth and shortage of safe assets, the neutral rate has been on the downward trend. Of course, low neutral interest rate portends short-term interest rates could frequently hit zero or fall into negative territory.

In some developed countries such as Sweden, Dernamark, Japan and Switzerland, negative interest rates have been successfully experimented against the anxiety about the risks and side effects from conventional economic thinking. And evidence points to the stimuli effect on economic activity from those countries.

In the South, between 2022 – 2023, countries such as Morocco, Barbodas, Cape Verde, Sychelles, Cambodia, Thailand, New Caledonia and Comorro between many others; have maintained their CBR between 0-3 percentage points while curbing inflation.

Why should Tanzania always mimic developed countries’ economic policies even when available data state otherwise?